2018 beryl elites alternative investments conference

NOVEMBER 5-6, 2018

Conference AGENDA

Prepare for Innovation 2018 is an overriding theme of the conference. Emerging technology is a critical competitive edge for both managers and investors and the conference will help all the participants to form valuable business relationships and to create a winning strategy. We will have 85+ speakers and 22 dynamic panels over the course of two days. Below list includes the topics that will be discussed at the conference.

The Evolution of Alternative Data: their deployment to improve portfolio allocation, optimization, and risk management

Identifying Innovative Niche Strategies: hedge fund managers describing risks/rewards in the current market environment

Artificial Intelligence and Alternative Data: the latest trends in private equity, venture capital, hedge funds

Uber Yourself Before You Get Kodaked: the conversation with Leading Innovators and Thought Leaders in Artificial Intelligence

Puerto Rico: Accelerated Economic Growth and Evolving Investment Opportunities

Changing Investors Demands: allocators discuss how to implement asset classes including hedge funds in a current investment environment

Using Artificial Intelligence in Investment Management: providing better investment outcomes to clients through the use of Artificial Intelligence and Machine Learning

Bitcoin, Cryptocurrencies and Blockchain: A New Alternative Investment Frontier or Just Over-Hyped

Puerto Rico Emerging Investment Opportunities: legal, accounting, and lifestyle

Hedge Fund Strategies: Allocators perspectives on Alpha Opportunities in 2019

Finding Alpha in Alternative Data: how managers turn big data into true informational edge

Various Flavors of Alt-Data and their Unique Features: geospatial data, credit card sales, sentiment analysis, social media feeds

Capturing and Retaining Value to Justify an Investment in Data: how are alternative data being used in investing

The Digital Revolution: Using Data, Artificial Intelligence & Machine Learning to Supercharge Customer Intelligence

Manager Search and Due Diligence: how to identify managers who are qualified and capable of making sophisticated and successful investments

Big Data and Real Estate: how data are changing the landscape of real estate and investments

Challenges in Machine Learning and AI: the markets playground is always shifting, influenced by a myriad of interconnected factors

The New Frontier on Wall Street: converting unstructured data into structured signals

Is the Bull Market Finally Coming to an End?: fundamental shifts in economic growth, inflation, rates, international trade, and geopolitics

Better Data Engineering: how to assess data procurement processes, how to reach the best insights the fastest

Alternative Data and Challenges to Managers: selecting the data from vendors, cleaning, incorporating data into processes

Blockchain and Artificial Intelligence: could blockchain help create better AI; could AI help create better blockchain

Why Emerging Technologies & Alternative Data

Disruption is here, and the world of finance is at its epicenter. Investment professionals need to upgrade their skill set to ensure their relevance in this new investment paradigm. Many businesses that are being disrupted by emerging technologies (i.e. artificial intelligence, alternative data, blockchain, digital media) will be addressed. The panelists for this conference will discuss the most thought-provoking themes, salient trends, and biggest investment opportunities that are revolutionizing various businesses and the way we perceive them. Our machine intelligence discussion includes artificial intelligence, deep learning, machine learning and their applications. Among other topics, we will also be addressing a rapidly expanding world of alternative data with the goal to better comprehend the value of companies and beyond.

These emerging technologies and alternative data are becoming more critical in all sectors of our economy. Innovative investment managers increasingly seek unstructured alternative data sources to help them outperform their peers by reaching the best insights the fastest. Alternative data includes such actionable sources as satellite images, social media feeds, logistics, credit card sales, mobile geolocation data, and sentiment data which are utilized by artificial intelligence techniques such as deep learning and reinforcement learning. These will become increasingly essential tools for those seeking new alpha or enhancing existing alpha in investment management as well as to those eager to augment and speed up their operational processes.

The conference can assist you to create a road-map for your next venture with lessons learnt from those who have it done before, and give you a chance to ask questions and learn from experts. Having a blueprint to implementation, a plan to scale-up and the right talent in place is critical to ensure your project results in the anticipated ROI. Managers and companies which devote resources in these areas will benefit from an "informational" edge.

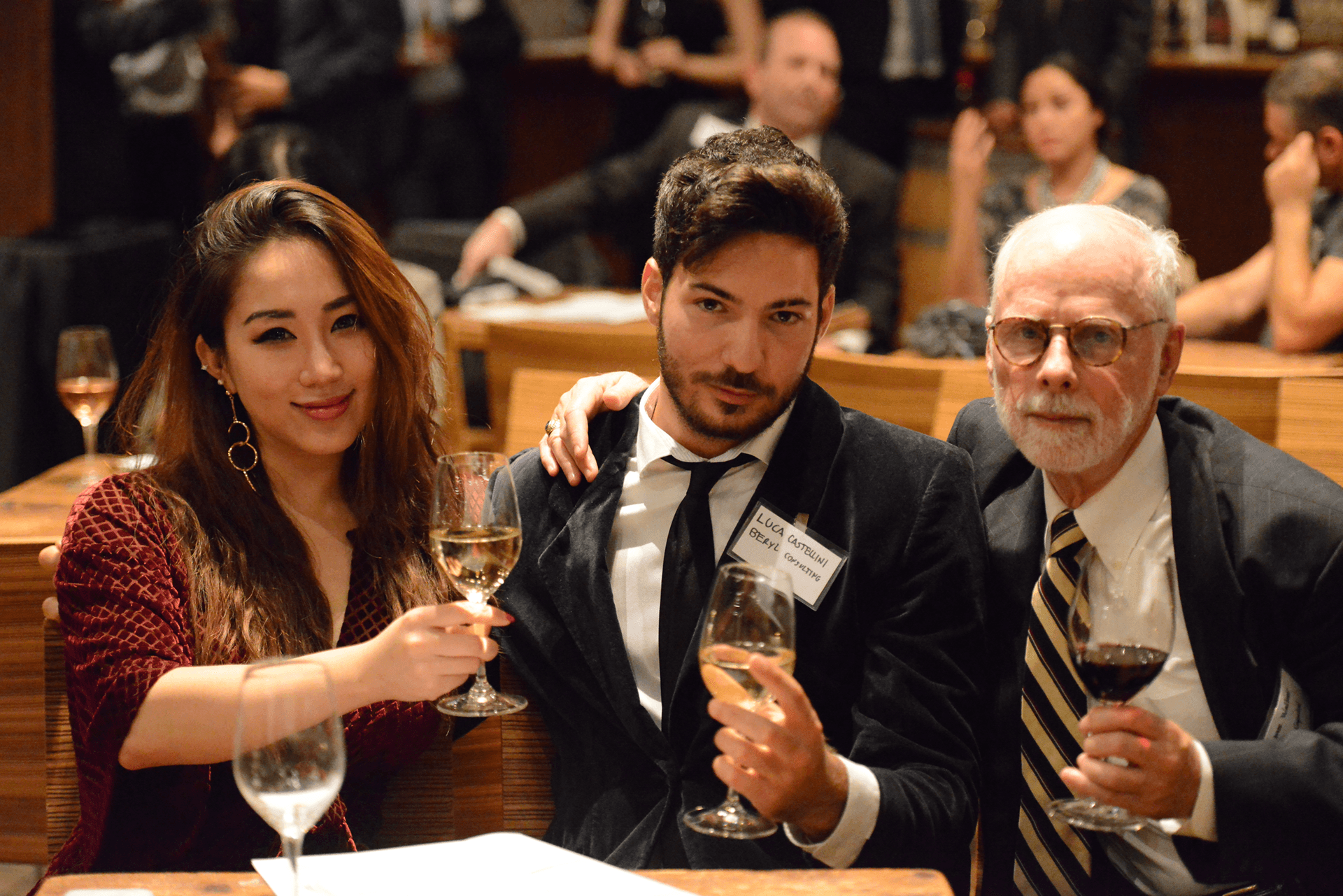

LIVE ENTERTAINMENT

Our conferences include evening live entertainment. Upon completion of panel discussions on Monday November 5th, we will provide exquisite entertainment for attendees to enjoy a variety of shows. We strongly believe that an inspirational and stimulating environment enhances the networking experience among conference participants.