Beryl · GTCOM GREATER CHINA CONFERENCE

ALTERNATIVE INVESTMENTS & alternative data

BEIJING

JULY 30-31, 2019

The Beryl Consulting Group and GTCOM are organizing their inaugural Greater China Alternative Investments and Alternative Data Conference in Beijing on July 30th and 31st. It is the first-ever conference to be held in mainland China showcasing the Alternative Data industry. The conference will feature emerging technologies and alternative data as a critical competitive edge for fund managers and investors in today’s intertwined and highly competitive global environment.

This year’s Beryl · GTCOM Greater China conference will have 250+ participants and 50+ exemplary speaker. At last year’s Beryl Elites conference in New York City, we hosted 90+ allocators, 50+ managers, representing over $850 billion in investable assets.

Who should attend? Government officials, policy makers, major asset allocators, fund of funds (RMB/USD), family offices, top hedge funds, private equity, venture capital, fintech start-ups, pre and post IPO companies, chief investment officers, chief executive officers, heads of asset classes, municipal pensions, and sovereign wealth funds, and visionaries from around the world.

All roads lead to Beijing and to our Venue. In keeping with our tradition of Finance and Art, we selected Blue Note Beijing, a top-level venue for our Greater China Conference. Blue Note is only a few steps away from the Forbidden City, The Great Hall of the People, and Zhongnanhai which houses the office of Premier of the People’s Republic of China.

Conference Background

WHY CHINA?

The sheer size and scale of the Chinese market provides tremendous upside for alternative investments. As the second largest economy in the world with 20% of the world’s population, China’s alternative funds industry has consistently grown in size and increased in sophistication. Morgan Stanley forecasts that there will be $7 trillion worth of assets being managed in China by 2023, almost doubling from current levels. In late February, MSCI announced that it will quadruple the weighting of Chinese mainland shares in its global benchmarks later this year. This move is expected to draw in tens of billions of foreign institutional inflows to China’s stock market which is heavily dominated by domestic retail accounts. Currently, institutional investors account for 15% of the market, and foreign institutions only 3% of the market . Furthermore, China’s A-shares indices has much lower correlations to developed markets equities cross indices, adding another attractive element to future foreign investors’ participation. China is also home to the largest venture capital market in the world.

China has the most active and robust digital ecosystem in the world, making it a fertile ground to exploit big data. China has now 200-300 million strong middle class and nearly 800 million mobile internet users. China’s rapid adoption of mobile payments systems and the advancement of information technology combined with its sheer market size, contribute to China’s leading position in big data, digital infrastructure, and e-commerce. This in turn empowers artificial intelligence and machine learning techniques, enabling advanced statistical analysis and highly defined predictive models. According to CB Insights, Chinese firms garnered 48% of global AI funding in 2017, compared to 38% that U.S. firms received that year.

Our Greater China conference will enable the participants to gain new insights about rapidly evolving Chinese capital markets, explore actionable investment opportunities, showcase innovative products, and establish highly valuable business relationships.

WHY ALTERNATIVE DATA?

Alternative data is a subset of big data. It refers to all data not generated from traditional data sources like company financial statements or economic statistics. Alternative data include mobile phone activity, transactional data from credit or debit cards, GPS tracking, satellite imagery, social media, and many other activities. In today’s highly competitive investments markets, investment managers are increasingly turning to advanced analytics and alternative data to better assess the future performance of publicly traded securities and deliver superior returns to their investors. More specifically, quant managers typically utilize alternative data with long history, allowing them to back-test the data. Fundamentally inclined managers prefer to utilize data to confirm a trend or a new research theme at a given point of time.

Beryl · GTCOM conference will present this new and dynamic alternative data ecosystem, adding an essential edge to your investment management process.

CONFERENCE AGENDA

Traditional Investments Management vs. The New Era of Big Data Investing

East meets West: Investment Themes and Practical Application for 2019/2020. What is in front of us, Geopolitics, International Trade, Policy & Governance Risks? Current investment trends in alternative asset allocation and macro-economic forecasts. Is the decade old Bull Market in the West finally coming to an end?

Chinese Investor Evolution: What are the global portfolio allocations needs and appetite and how to implement asset classes and improve the return for Chinese pension fund allocation? Assessing Chinese asset managers' global expansion in the New Era, what are some of opportunities and challenges?

China's push forward the Reform and opening up of China's Capital Market : Experts discuss how to further improve the trading mechanism and make the financial sector better serve the real economy. New developments effecting the Chinese pension system and insurance industry.

Perspectives from Global Exchange Leaders, Allocators, and Managers: Integrating the A Shares market into the global equities investing. Discussing fundamental shifts in economic growth, inflation, rates, international trade, and geopolitics. Exploring mainland China Asset Management and Private Equity Opportunities. How to best prepare for this Next Frontier?

Manager Search and Due Diligence, Mainland China versus the U.S.: Manager selection process, what are similarities, differences and challenges. Identifying China and off-shore managers. Rotation in Different Strategy & Asset Classes. Opportunities set in Greater China for investors.

Global Financial Firms entering China's Capital Markets: China’s stock market has the world’s second biggest capitalization but foreign investors can only access it via limited channels such as the Qualified Foreign Institutional Investor scheme or the Shanghai-Hong Kong Stock Connect. Experts discuss current trend and opportunities including managers of managers fund structures.

The Rise of Multi-Family Offices in China: The sector comprises of private bankers, asset managers, accountants and lawyers. What are some opportunities and challenges for all stakeholders in this nascent financial sector.

The Digital Revolution and Disruption: Deploying data, artificial intelligence & machine learning to supercharge customer experience and intelligence. Greater China Inroads to Big Data - how Chinese technology firms are leading the innovations in artificial intelligence and big data.

Alternative Data, Machine Learning and Artificial Intelligence in Investment Management: Effective deployment of this new ecosystem to improve portfolio allocation, optimization, and risk management. Providing better investment outcomes to clients through the use of artificial intelligence and machine learning. Accessing the Market & Regulatory landscape.

The Quantamental Shift. Using Alternative Data to Generate Alpha: How fund managers turn data and information graphs into informational edge. Allocators and managers perspectives on new datasets and alpha opportunities.

The New Frontier on Wall Street: Converting unstructured data into structured signals. Various Flavors of Alternative Data and their Unique Features -geospatial data, credit card sales, sentiment analysis, social media feeds. Challenges in machine learning and artificial intelligence.

Alternative Data and Challenges to Managers: Selecting the data from vendors, pricing, cleaning, incorporating data into processes. Better Data Engineering, how data scientists assess data procurement processes, how to reach the best insights the fastest.

Why Participate IN THE CONFERENCE?

Qualified Investors and Asset Allocators

In order to generate high investment returns, you must surround yourself with leading managers and investors, understand their outlook on the market, and hear about the latest investment tools and trends from cutting-edge data scientists. Beryl · GTCOM conference provide this vast intellectual ecosystem of think tanks to help you stay on top of your game.

Fund Managers

Whether you are a fundamental manager looking to expand horizons and enter into the new world of alternative data, AI/ML or a quanta-mental / quant manager seeking to strengthen domain knowledge, source new investment ideas and generate actionable signals, our conference will add substantial value to your cap-intro event calendar.

Alternative Data Vendors and Service Providers

Beryl · GTCOM conference provide you with a platform to showcase your products and service as a thought leader. The best way to market your products or services is to share your knowledge and insights with a highly curated audience of managers, investors, and allocators. Selling products or services is just a natural outcome.

High-Tech Companies

Seeking potential investors? Looking to learn more from our experts? Beryl · GTCOM conference provide the most efficient and successful environment to establish relationships with potential investors. Our conference will assist you in creating a road-map for your next venture with advice and direction from world renowned experts.

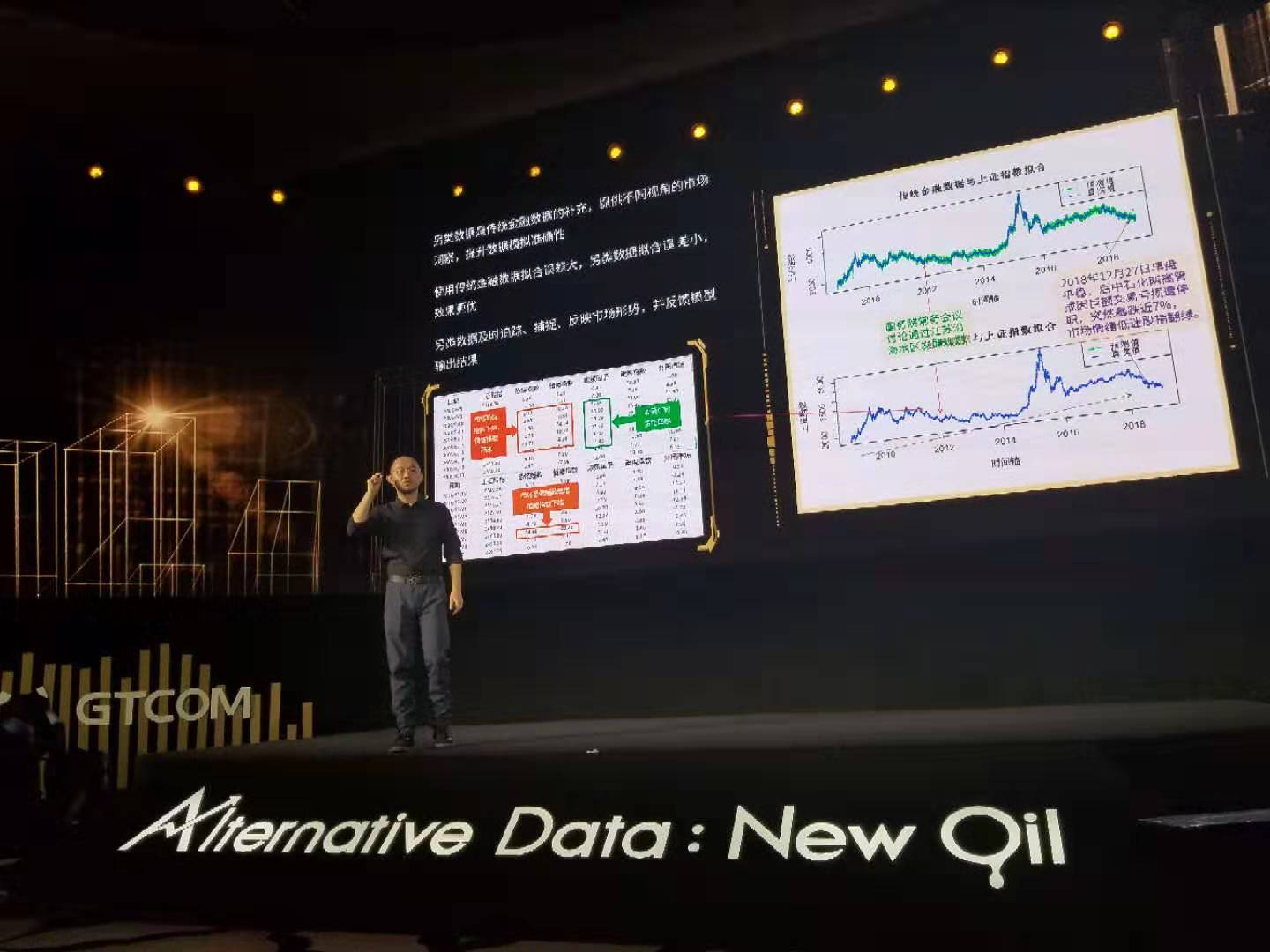

Global Tone Communication Technology

Global Tone Communication Technology Co., Ltd. (GTCOM) is a world-leading big data and artificial intelligence company. It provides global corporate users with comprehensive cutting-edge scenario-based solutions powered by big data and artificial intelligence. As one of the earliest companies that engaged in the research of Alternative Data in China, GTCOM has used NLP sentiment algorithms based on leading big data algorithms and financial data analysis capabilities to quantitatively calculate multidimensional reference factors such as policy factors, sentiment factors, risk factors and growth factors. GTCOM has become the significant solution provider for Alternative Data.

BERYL ELITES CONFERENCE

Beryl Elites Conferences are highly curated Alternative Investments Conferences focusing on inspiring innovations. Beryl Elites began as an extension of The Beryl Consulting Group, with the specific purpose of bringing qualified institutional investors and family offices together with a diverse group of industry experts, willing to share ideas, develop strategies, and create synergies. Our conference partners include institutional investors, major corporations, hedge funds, private equity and venture capital firms, family offices, fintech, entrepreneurs, visionaries, and artists.

Beryl Elites Conference enables the participants to gain new insights and vision, showcase products, explore opportunities, and establish business relationships. Expert panelists discuss thought-provoking themes, trends, and actionable investment opportunities. We typically host over 250 senior executives and decision makers.

THE VENUE

Blue Note Beijing Ch'ien men 23, Beijing, China

In keeping with our tradition of Finance and Art, we selected Blue Note Beijing, a top-level venue for our Greater China Conference. Blue Note is an exquisite and elegant venue providing intimacy and a relaxed networking environment similar to our New York City’s venues where we hold our annual Beryl Elites Alternative Investment Conferences. The typical conference distractions - hotel concierge, bell hops, and the always-present plethora of tourists will neither interfere with the focus or agenda. The design and acoustics are superb, with no second guessing about what was stated by panelists or understanding provocative comments and questions from participants. While Blue Note Beijing carries the ancient history of China, one can feel the combined sense and spirit of Chinese and Western culture and East meets West.

Unlike other modern cities in China, Beijing is an ancient capital like Rome. As the saying goes, “All roads lead to Rome.” With China’s rapid rise of power on the world’s stage, one can argue that “All roads lead to Beijing.” What is unique about Blue Note Beijing is its location and history. Located on the southeast side of Tiananmen Square, it now occupies the former U.S. Embassy, and it is the only foreign Embassy building complex in Beijing that remains intact since Qing Dynasty. Blue Note is only a few steps away from the Forbidden City, The Great Hall of the People, and Zhongnanhai which houses the office of Premier of the People’s Republic of China.

LIVE ENTERTAINMENT

The unique tradition of Beryl Elites conferences, is the consolidation of finance and art. Art is the source of innovation, inspiration and stimulation and we support the arts to enhance the networking experience among our conference participants. Upon completion of panel discussions, we provide exquisite entertainment and networking opportunities for all attendees.

GREATER CHINA CONFERENCE CO-HOST

Beryl Elites Conference

Beryl Elites began as an extension of The Beryl Consulting Group, with the specific purpose of bringing qualified institutional investors and family offices together with a diverse group of industry experts, willing to share ideas, develop strategies, and create synergies. Our conference partners include institutional investors, major corporations, hedge funds, private equity and venture capital firms, family offices, fintech, entrepreneurs, visionaries, and artists. Beryl Elites Conference enables the participants to gain new insights and vision, showcase products, explore opportunities, and establish business relationships. Expert panelists discuss thought-provoking themes, trends, and actionable investment opportunities. We typically host over 250 senior executives and decision makers.

GTCOM

Global Tone Communication Technology Co., Ltd. (GTCOM) is a world-leading big data and artificial intelligence company. It provides global corporate users with comprehensive cutting-edge scenario-based solutions powered by big data and artificial intelligence. As one of the earliest companies that engaged in the research of Alternative Data in China, GTCOM has used NLP sentiment algorithms based on leading big data algorithms and financial data analysis capabilities to quantitatively calculate multidimensional reference factors such as policy factors, sentiment factors, risk factors and growth factors. GTCOM has become the significant solution provider for Alternative Data.

CUFE

Central University of Finance and Economics (CUFE) is a prestigious university under the direct leadership of the Ministry of Education (MOE) and jointly supported by the MOE, the Ministry of Finance and the People’s Government of Beijing Municipality. It is one of China’s top universities listed under the Project “Double FirstClass” university and the Project 211,and in the first batch to become a Leading Academic Programs Innovation Platform.